Fraud Protection

Your Security Is Our Priority

We understand that in today's digital age, fraud can happen to anyone. We are committed to safeguarding your financial information and helping you stay protected against fraud. Here you'll find useful tips, tools, and resources to help you recognize, prevent, and respond to fraudulent activities.

How We Protect You

Fraud Monitoring

Our advanced fraud detection system constantly monitors your transactions for any unusual activity. If we spot something out of the ordinary, we'll alert you immediately, so you can take action quickly.

Real-Time Alerts

Stay in the know with instant notifications about your account activity. Receive text or email alerts whenever there's a large purchase, a new login, or other potentially suspicious behavior.

Multi-Factor Authentication

We utilize state-of-the-art encryption, multi-factor authentication (MFA), and secure login methods to protect your personal information and prevent unauthorized access.

Control Your Cards on Your Terms

Our CardProtect tool allows you to control and monitor your debit and credit cards, giving you the ability to turn your cards on/off at your discretion, add alerts, set spending limits based on location, amount, merchant type or transaction type, and more.

Regularly Clear Your Browser History

Regularly clearing your browsing history helps protect your online security and reduces the risk of cyber threats. By removing stored data like visited websites, cookies, and cached files, you limit what hackers can learn about your online activity - keeping your personal information safer.

Common Types of Fraud

The best line of defense in preventing fraud is being able to detect it. Learn about the most common scams and how you can spot them.

What to do if you suspect fraud

- Notify your bank and credit card issuers immediately so they can close your accounts.

- Report the fraud to the Federal Trade Commission at ReportFraud.FTC.gov

- Contact the fraud unit of the three credit reporting agencies. Place a fraud alert on your credit report and consider placing a credit freeze so the criminal can’t open new accounts. The fraud unit numbers are:

- Equifax: (866) 349-5191

- Experian: (888) 397-3742

- TransUnion: (800) 680-7289

- File a police report.

- Make sure to maintain a log of all the contacts you make with authorities regarding the matter. Write down names, titles and phone numbers in case you need to contact them again or refer to them in future correspondence.

To learn more about fraud and identity theft prevention, visit the Federal Trade Commission's Scam Alerts page, or click below to view valuable resources on how to report, notify, mitigate, and dispute incidents of identity theft.

Celebrating 100 Years of Banking in Sidney

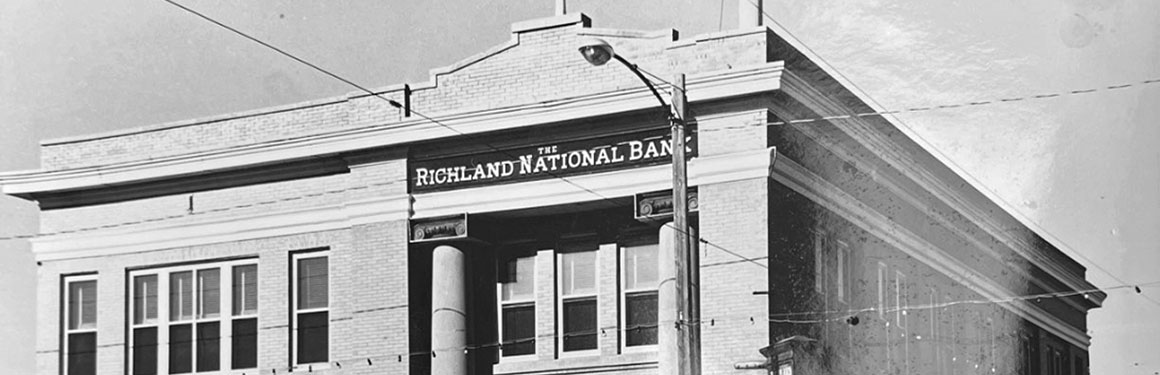

Sidney – This year marks a special milestone as 100 years of banking is celebrated in our community. While Stockman Bank has proudly served the community since 1980 and under its current name since 1998, they honor the long history in Sidney that began with Richland National Bank in 1925 - a history of service, growth, and commitment to the people of eastern Montana.

Stockman Bank’s deep roots in Sidney started with the original founders of Richland National Bank—Axel Nelson, J.S. Day, Ira M. Alling, and Dr. I.J. Peterson—who in 1925 established Richland National Bank with a vision to serve Sidney’s merchants, farmers, and ranchers. From an initial capital of $35,000 and deposits totaling $16,891.59, the bank steadily grew in both scope and stature.

Over the years, Richland National Bank was led by a dedicated group of presidents: J.S. Day, Axel Nelson, Glenn Hall, H.J. "Bud" Nelson, and Jay Lalonde. Each brought unique leadership during times of economic change and community development.

A pivotal moment came in 1980, when Stockman Bank acquired Richland National Bank. At the helm of this transition was Robert J. Goss, who became the first president of the Sidney bank under the Stockman Bank name. Bob Goss led the bank through more than two decades of significant growth, community outreach, and financial stewardship. Under his leadership, Stockman Bank Sidney became one of the top-performing banks in the organization. His commitment to community development, education, and agriculture left an enduring impact.

A pivotal moment came in 1980, when Stockman Bank acquired Richland National Bank. At the helm of this transition was Robert J. Goss, who became the first president of the Sidney bank under the Stockman Bank name. Bob Goss led the bank through more than two decades of significant growth, community outreach, and financial stewardship. Under his leadership, Stockman Bank Sidney became one of the top-performing banks in the organization. His commitment to community development, education, and agriculture left an enduring impact.

In 2006, Garth Kallevig succeeded Goss as President. A Sidney native with deep ties to the area and years of experience within the bank, Kallevig brought continuity and strong leadership. His tenure as Market President further solidified Stockman Bank's reputation for community-centered banking, while supporting local initiatives and economic development. Kallevig retired in 2021, passing the torch to the current Sidney Market President, Wade Whiteman.

In 2006, Garth Kallevig succeeded Goss as President. A Sidney native with deep ties to the area and years of experience within the bank, Kallevig brought continuity and strong leadership. His tenure as Market President further solidified Stockman Bank's reputation for community-centered banking, while supporting local initiatives and economic development. Kallevig retired in 2021, passing the torch to the current Sidney Market President, Wade Whiteman.

Whiteman, also an eastern Montana native, continues to guide the Sidney market with a forward-looking vision rooted in tradition. His leadership reflects Stockman Bank’s enduring values of integrity, customer service, and community involvement.

Whiteman, also an eastern Montana native, continues to guide the Sidney market with a forward-looking vision rooted in tradition. His leadership reflects Stockman Bank’s enduring values of integrity, customer service, and community involvement.

At the heart of Stockman Bank’s success has been its unwavering dedication to local decision making and leadership. Decisions are made by people who live and work in the communities they serve—people who understand the unique needs, challenges, and opportunities of Montana life. This focus on local leadership ensures that every financial decision is backed by a deep understanding of the region and a shared investment in its future.

As a family-owned community bank, Stockman has remained committed to enriching the lives of Montanans and helping local communities succeed. The bank blends traditional western values—honesty, hard work, and neighborliness—with state-of-the-art technology and modern convenience. Stockman Bank proudly serves as a full-service financial partner, offering services uniquely tailored to meet the needs of Montana families, farms, ranches, and businesses.

In addition to being grounded in local decision making and traditional western values, giving back has also been central to Stockman Bank’s identity. Whether through sponsorships, donations, volunteerism, or leadership in local organizations, the Sidney bank has remained deeply engaged in supporting the community's well-being and future growth.

Today, Stockman Bank in Sidney stands as a pillar of strength, proudly serving generations of Montanans with personalized service, forward-thinking solutions, and an enduring commitment to community. With continued expansion, innovation, and a deep connection to Montana’s way of life, Stockman Bank looks ahead to a future that honors its past and embraces its role as a cornerstone of the community.

Stockman Bank thanks their loyal employees, customers, friends, and community members who have been part of the journey and looks forward to the next 100 years of service and growth together.

Join Stockman Bank for the Celebration! The entire community is invited to attend the 100-Year Celebration at Stockman Bank on Monday, April 14, 2025, from 11:00am to 2:00pm at their Sidney bank located at 301 W Holly Street. Stop by for refreshments, treats, and giveaways.