Home Loans

Apply NowMontana's Choice for Home Loans

We all know the purchase of a home is one of life's biggest milestones. You'll want a local lender on your side to be your advocate as you navigate the mortgage process. Our home loan experts are your future community members and will work hard on your behalf to secure a competitive rate and get you into your dream home as quickly as possible. What's better - if you're in a competitive buying situation, a home loan from a trusted local lender may make your offer more favorable. Start your home loan process today with one of our experienced lenders.

Make Your Loan Decision Confidently

We believe our clients deserve transparency about their loan options, and our total cost analysis gives you the information you want to have about your loan. The first step is to get pre-qualified by one of our home loan professionals.

What type of loan is right for me?

Every borrower is unique. The right loan choice depends on many factors. We highly recommend talking with one of our Real Estate Loan Officers who can help guide you through the process. Here is some general information about several different loan program options.

Fixed Rate or Adjustable Rate

A fixed-rate loan provides a fixed rate throughout the life of the loan, meaning the rate will not change 10, 20, or 30 years from now. A fixed-rate loan may be the better choice if you want stable payments and plan to live in your home long-term.

With adjustable-rate mortgages (ARMs), the interest rate will fluctuate over time. ARMs can either go up or down, which will affect your monthly payment. An ARM may be a good option if you only plan to live in your home for a few years.

Conventional Loan

With a conventional loan, the lender assumes the risk for lending you money. As a result, conventional loans have more stringent credit requirements and higher down payment requirements.

- Conforming loans are those that adhere to loan limits set by the Federal Housing Finance Agency (FHFA). As of 2025, the conforming loan limit is $806,500 for one-unit properties.

- Jumbo loans are those that exceed the conforming loan limits. Interest rates are usually higher on jumbo loans because they represent greater risk to the lender. There may also be stricter credit standards and underwriting requirements.

Government-Sponsored Loan

With a government-sponsored loan, such as FHA, VA, or USDA, the government backs the loan, or assumes the risk for lending you money. They typically have easier requirements to qualify for, and can have as little as no downpayment.

- FHA loans are backed by the Federal Housing Administration (FHA). Because of reduced requirements to qualify, borrowers are required to pay a mortgage insurance premium (MIP) on top of their monthly payment.

- VA loans are backed by the U.S. Department of Veterans Affairs, and require no down payment (100% financing) and no mortgage insurance. They are available to eligible veterans, active-duty members, reservists, National Guard members, and surviving spouses.

- USDA loans are backed by the U.S. Department of Agriculture, and are available for homes in eligible rural areas. While USDA loans do not require a down payment, they do require mortgage insurance.

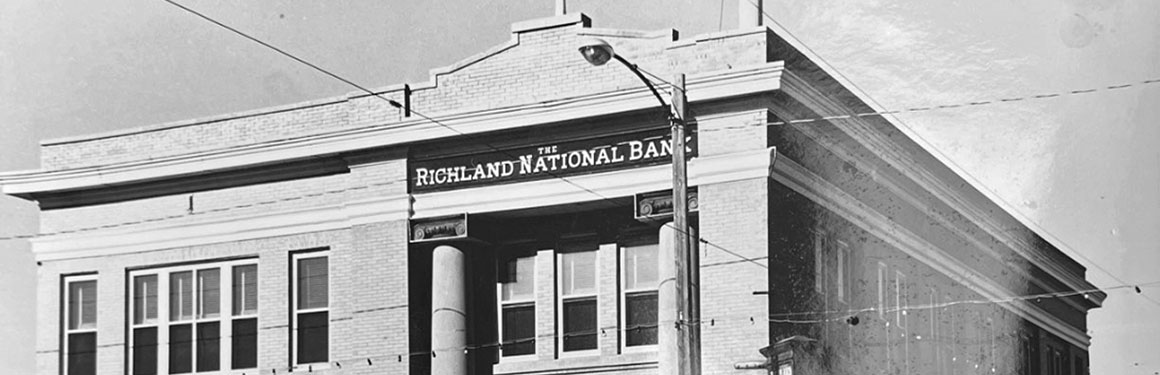

Celebrating 100 Years of Banking in Sidney

Sidney – This year marks a special milestone as 100 years of banking is celebrated in our community. While Stockman Bank has proudly served the community since 1980 and under its current name since 1998, they honor the long history in Sidney that began with Richland National Bank in 1925 - a history of service, growth, and commitment to the people of eastern Montana.

Stockman Bank’s deep roots in Sidney started with the original founders of Richland National Bank—Axel Nelson, J.S. Day, Ira M. Alling, and Dr. I.J. Peterson—who in 1925 established Richland National Bank with a vision to serve Sidney’s merchants, farmers, and ranchers. From an initial capital of $35,000 and deposits totaling $16,891.59, the bank steadily grew in both scope and stature.

Over the years, Richland National Bank was led by a dedicated group of presidents: J.S. Day, Axel Nelson, Glenn Hall, H.J. "Bud" Nelson, and Jay Lalonde. Each brought unique leadership during times of economic change and community development.

A pivotal moment came in 1980, when Stockman Bank acquired Richland National Bank. At the helm of this transition was Robert J. Goss, who became the first president of the Sidney bank under the Stockman Bank name. Bob Goss led the bank through more than two decades of significant growth, community outreach, and financial stewardship. Under his leadership, Stockman Bank Sidney became one of the top-performing banks in the organization. His commitment to community development, education, and agriculture left an enduring impact.

A pivotal moment came in 1980, when Stockman Bank acquired Richland National Bank. At the helm of this transition was Robert J. Goss, who became the first president of the Sidney bank under the Stockman Bank name. Bob Goss led the bank through more than two decades of significant growth, community outreach, and financial stewardship. Under his leadership, Stockman Bank Sidney became one of the top-performing banks in the organization. His commitment to community development, education, and agriculture left an enduring impact.

In 2006, Garth Kallevig succeeded Goss as President. A Sidney native with deep ties to the area and years of experience within the bank, Kallevig brought continuity and strong leadership. His tenure as Market President further solidified Stockman Bank's reputation for community-centered banking, while supporting local initiatives and economic development. Kallevig retired in 2021, passing the torch to the current Sidney Market President, Wade Whiteman.

In 2006, Garth Kallevig succeeded Goss as President. A Sidney native with deep ties to the area and years of experience within the bank, Kallevig brought continuity and strong leadership. His tenure as Market President further solidified Stockman Bank's reputation for community-centered banking, while supporting local initiatives and economic development. Kallevig retired in 2021, passing the torch to the current Sidney Market President, Wade Whiteman.

Whiteman, also an eastern Montana native, continues to guide the Sidney market with a forward-looking vision rooted in tradition. His leadership reflects Stockman Bank’s enduring values of integrity, customer service, and community involvement.

Whiteman, also an eastern Montana native, continues to guide the Sidney market with a forward-looking vision rooted in tradition. His leadership reflects Stockman Bank’s enduring values of integrity, customer service, and community involvement.

At the heart of Stockman Bank’s success has been its unwavering dedication to local decision making and leadership. Decisions are made by people who live and work in the communities they serve—people who understand the unique needs, challenges, and opportunities of Montana life. This focus on local leadership ensures that every financial decision is backed by a deep understanding of the region and a shared investment in its future.

As a family-owned community bank, Stockman has remained committed to enriching the lives of Montanans and helping local communities succeed. The bank blends traditional western values—honesty, hard work, and neighborliness—with state-of-the-art technology and modern convenience. Stockman Bank proudly serves as a full-service financial partner, offering services uniquely tailored to meet the needs of Montana families, farms, ranches, and businesses.

In addition to being grounded in local decision making and traditional western values, giving back has also been central to Stockman Bank’s identity. Whether through sponsorships, donations, volunteerism, or leadership in local organizations, the Sidney bank has remained deeply engaged in supporting the community's well-being and future growth.

Today, Stockman Bank in Sidney stands as a pillar of strength, proudly serving generations of Montanans with personalized service, forward-thinking solutions, and an enduring commitment to community. With continued expansion, innovation, and a deep connection to Montana’s way of life, Stockman Bank looks ahead to a future that honors its past and embraces its role as a cornerstone of the community.

Stockman Bank thanks their loyal employees, customers, friends, and community members who have been part of the journey and looks forward to the next 100 years of service and growth together.

Join Stockman Bank for the Celebration! The entire community is invited to attend the 100-Year Celebration at Stockman Bank on Monday, April 14, 2025, from 11:00am to 2:00pm at their Sidney bank located at 301 W Holly Street. Stop by for refreshments, treats, and giveaways.

1. Get prequalified. Find out how much home you can afford.

2. Find a home. Work with your agent to find your dream home and make an offer.

3. Get a mortgage. Make a plan that meets both your current and future goals. Our home lending experts will help you!

4. Close. Become the legal owner of your new home!

5. Move in. One journey ends and another begins!

Typically, you will need to put down between 3% and 20% to qualify for a conventional loan, but there are also exceptions. You may be eligible for zero down payment options if you are a veteran, or USDA Rural Development Loan Programs

Why 20% is considered ideal

Putting down 20% or more comes with several benefits. The more money you put down, the lower your payment will be, but at 20% or more you avoid paying mortgage insurance. Additionally, you might receive reduced interest rates, and it may help you be a more competitive buyer and stand out to sellers, especially if there are multiple offers on the home.

Less than 20% down is okay too

If you have less than a 20% down payment, you still have options! Our Real Estate Loan Officers can help guide you through the decision making process, to help you achieve both your short term and long term financial goals.

Lenders look at a variety of factors when determining if you qualify for a loan.

The 4 C's of Qualifying for a Loan:

Character represents your credit history or financial integrity. Your credit score, how much credit you’ve used in the past, and whether you make your payments on time are examples of your financial integrity.

Capacity represents your ability to repay a loan. The amount of your income and assets are compared against your monthly debts to make sure you can afford a loan.

Collateral is the asset securing the loan — in other words, the value of the home itself. If you default on your payments, the home can be repossessed by the lender.

Capital is how much money you’re able to invest in the collateral, represented by your down payment. The amount of capital you contribute shows that you have “skin in the game” and reduces the risk to the lender.

Before you start looking at houses, work with your loan officer to get pre-qualified, so you know how much home you can afford. This can help you narrow your home search to houses within your budget, give you an idea of how much you’ll need for a down payment, and help you identify budgeting goals to work toward.

While getting pre-qualified can be a big advantage during your home search, it’s not a guarantee for a loan. Getting approved for a mortgage happens later in the process.

Mortgage Insurance (MI), also referred to as private mortgage insurance (PMI), or mortgage insurance premium (MIP), protects the lender in the event that you fall behind on your mortgage payments. If you put down less than 20% when you buy your home, or if you take out an FHA loan, you’ll have to pay MI. Some loan programs, like VA loans, don’t require MI, no matter your down payment.

While MI adds to your monthly mortgage payment, it can be worth it by helping you purchase a home sooner. For example, let’s say you only have 5% saved up for a down payment. Rather than waiting to save up for a full 20% down payment, which could take years, you could purchase a home now with your 5% down payment and pay MI as a tradeoff.

In addition to your down payment and monthly mortgage payment, there are several other costs that come with buying a home. These are called closing costs.

Closing costs often represent one of the most unexpected expenses for homebuyers. They typically account for 2% to 5% of the home’s purchase price, so it’s important to save for them ahead of time. Closing costs are due on closing day, or the day you sign your loan paperwork and the property title is transferred into your name. Everyone’s closing costs vary slightly, but below are some examples of what might be included:

- Appraisal Fee: A fee paid to the appraiser to estimate the fair market value of your home.

- Attorney Fees: If your state requires an attorney to be present at closing, you’ll be responsible for any applicable attorney fees.

- Credit Report Fee: A fee paid to the lender that covers the cost of pulling your credit report. Your lender looks at your credit history to determine your creditworthiness, or how likely you are to repay your debt.

- Discount Points: An optional, upfront fee that you can pay to lower your interest rate over the life of your loan. One point typically equals 1% of the loan amount.

- Home Inspection Fee: A fee paid to the home inspector for assessing the home’s condition and identifying any needed repairs.

- Origination Fee: A fee charged by the lender for originating or creating the loan. Typically 1% of the loan amount.

- Prepaid Expenses: A portion of your property taxes, homeowners insurance, and accrued mortgage interest will need to be paid up front at closing.

- Recording Fees: Fees paid to your local government for recording the real estate purchase and making it a part of public record.

- Title Service Fees: Fees paid to the title company covering the title search, title examination, title insurance, and in some states, the fee for facilitating your closing.

Aside from the actual real estate transaction, there are several other fees that come with buying a home. These will vary depending on your situation, but be sure you also save for:

- Moving costs. From packing supplies to hiring a moving company, moving can hit you with a lot of unexpected expenses. Make sure you budget and save for these ahead of time.

- Maintenance & repairs. Owning a home includes the added responsibility of upkeep. If an appliance breaks down or your roof starts to leak, you'll have to cover the costs to repair it.

- Utility Bills: Moving from an apartment to a house? If you weren't paying for water and garbage before, be aware that you'll be responsible for these charges going forward, in addition to your normal utilities.

- Homeowners' Association Fees: If you move into a condo, townhouse, or subdivision, you may have to pay a monthly HOA fee to cover amenities, which may include trash removal, lawn care, and access to a community clubhouse, pool, or gym, to name a few.

The checklist below will give you an example of the most commonly requested items, but each loan application is unique so your lender may request more, or less, documentation after reviewing your application.

Verifying your income

Income verification involves not only verifying what you currently receive, but also determining the likelihood that you will continue to receive that income in the future.

- Paystubs from within the last 60 days

- W2s from the last two years

- Social Security Income? – collect a copy of your award letter and most recent bank statement showing the deposit going into your account

- Pension, disability, or other automatic income deposits? Copy of award letter showing how long you will receive the income for, and the amount you will receive.

- Rental Income? Locate up to most recent two years of tax returns

Verifying your assets

Which account are your closing costs or down payment funds coming from? Lenders are required to verify certain funds are readily available in your account and are also required to trace the source of certain large deposits.

- Two most recent bank statements, make sure they are within the last 60 days, and you provide all pages of the statement. (yes, even the blank ones)

- If you are listing retirement account funds on your application, we’ll need a copy of your most recent quarterly account statement.

Are you Self-Employed?

If you are self-employed, or a portion of your household income is from self-employment, additional documents will be requested

- Two years of business tax returns, with all schedules (if applicable)

- Most recent three months of business bank account statements dated

- Year-to-date Profit and Loss statement

Do you receive Rental Income?

Lenders are required to verify the total monthly payment amounts for each rental property, including the amount owed for financing, property taxes, insurance, or HOA dues.

- Most recent mortgage statement for each financed property

- Copy of your property tax bill and hazard insurance declarations page for each property owned

1. Don't apply for credit (such as a new credit card, car loan, or financing for furniture or appliances)

2. Don't make major purchases

3. Don't liquidate funds

4. Don't make large deposits

5. Don't switch jobs

All of these factors could impact your final closing, even if you’ve already been approved!